Business Insurance in and around Beaverton

Looking for coverage for your business? Look no further than State Farm agent Courtney Rogers!

Helping insure businesses can be the neighborly thing to do

- Beaverton

- Tigard

- Portland

- Lake Oswego

- Tualatin

- Oregon

- Washington

- California

- Nevada

- Idaho

- Clackamas

- Vancouver

- Salem

- Gresham

- Hillsboro

- Forest grove

- Sherwood

- Newburg

Help Prepare Your Business For The Unexpected.

You've put a lot of resources into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a window treatment store, a veterinarian, an art gallery, or other.

Looking for coverage for your business? Look no further than State Farm agent Courtney Rogers!

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, commercial liability umbrella policies or surety and fidelity bonds.

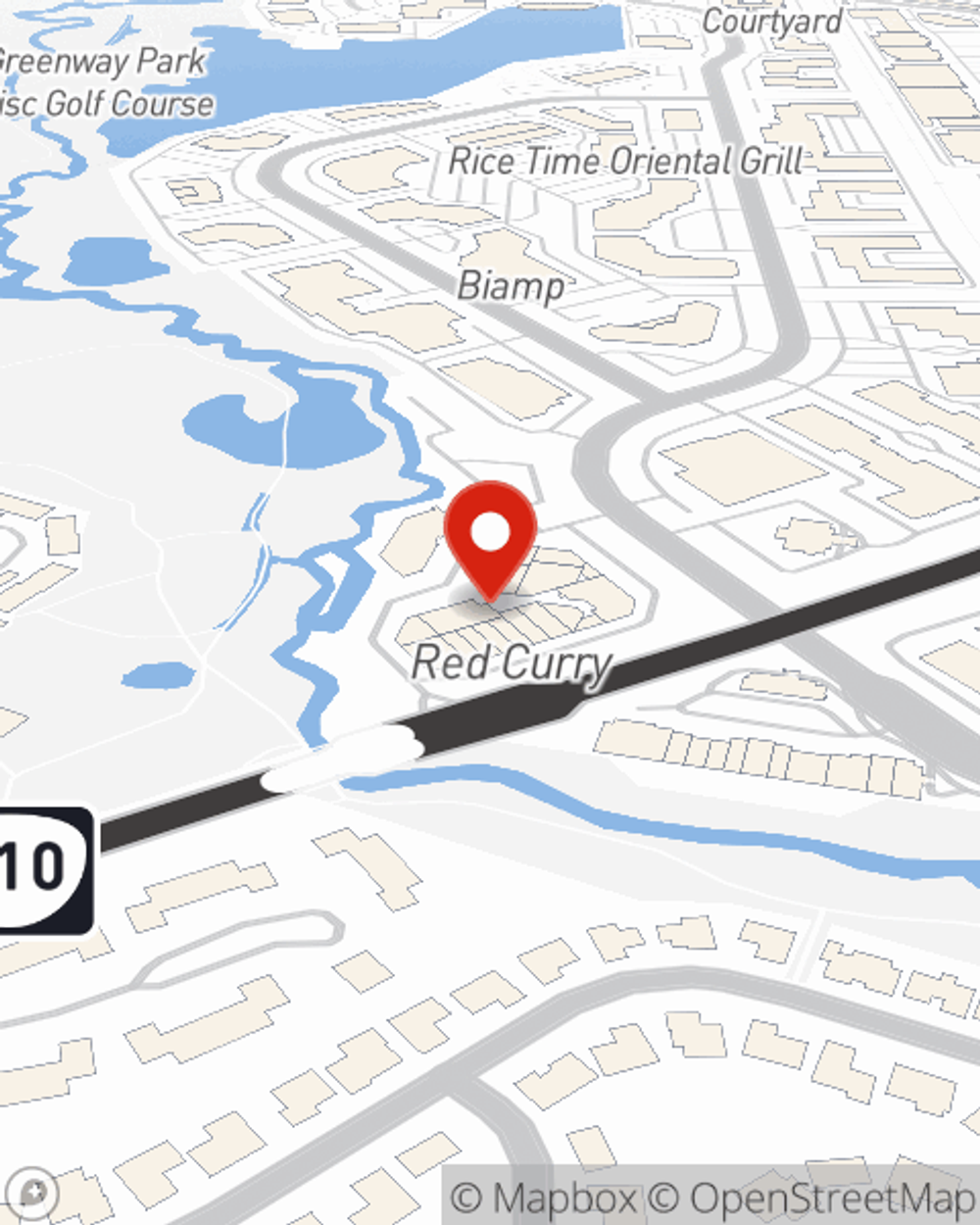

As a small business owner as well, agent Courtney Rogers understands that there is a lot on your plate. Visit Courtney Rogers today to chat about your options.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Courtney Rogers

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.